- Valley Recap

- Posts

- 🚀 AI INFRA 4 RECAP: AI Infrastructure Crosses the Next Threshold 📷 Say "INFRAAA" 💰 Bay Area Startups Collectively Secured $1.92B this week

🚀 AI INFRA 4 RECAP: AI Infrastructure Crosses the Next Threshold 📷 Say "INFRAAA" 💰 Bay Area Startups Collectively Secured $1.92B this week

AI INFRA 4 RECAP: AI Infrastructure Crosses the Next Threshold

Over 650 founders, investors, and infrastructure leaders gathered in San Francisco for AI INFRA SUMMIT 2025 to examine one urgent reality: AI is outgrowing its foundations. From GPU bottlenecks to energy scarcity, the conversations moved beyond hype to the mechanics of scaling intelligence in a constrained world. Every talk, panel, and fireside centered on how to keep pace with model demand while strengthening the hardware, power, and policy layers that sustain it.

NeoCloud Panel: Duncan Ng (Vultr) Kyle Sonowski (Crusoe) Derrick Horton (Tensorwave) Carl Brown (Supermicro)

CORE THEMES

Compute as Currency

Speakers agreed that GPU access now defines competitiveness. Bill Barry (IgniteGTM) called it a “national mandate,” noting that the United States holds 51 percent of hyperscale AI data centers and aims to double capacity within five years. Capital flows are compounding, roughly one trillion dollars this year and expected to exceed seven trillion by 2030, with each dollar driving two to three more through the supply chain. The message was clear: compute is not a tool, it is the economy.

Power is the Constraint

The Department of Energy’s forecast of two hundred gigawatts of behind-the-meter demand by 2030 set the tone for urgency. Almost 90 percent of existing data centers cannot handle AI workloads. Rack densities are rising from 10 kilowatts to more than 250 kilowatts, forcing operators to look behind the meter for solutions. Microgrids, natural gas turbines, and nuclear partnerships are shifting from experiments to requirements. Crusoe, Vultr, TensorWave, and Supermicro each framed power as the true currency of growth.

Ted Marena (AMD), Erik Norden (Zyphra), Thomas Jorgensen (Supermicro), and Wei Zhou (Semianalysis)

From Training to Inference

Marco Nicosia (AMD) and Shimon Ben-David (WEKA) traced the compute migration from large-scale training to massive inference. Memory is becoming the new bottleneck as models think longer and reason internally. Offloading KV cache to shared storage can multiply usable GPU output fourfold, showing how efficiency is overtaking scale as the competitive edge.

The Internet of Agents

Papi Menon from Cisco introduced AGNTCY, now under the Linux Foundation, describing how autonomous agents will need standards for discovery, security, and interoperation, an “Internet of Agents” that mirrors the early web.

Designing for Machines, Not Humans

Lazarev Agency noted that bots and agents already make up five to seven percent of global web traffic. Their concept of an “Agent Web” reframes UX for machine consumers, signaling a future where optimization targets algorithms as much as people.

What It Signals

The summit revealed a market shifting from speculative buildouts to operational discipline. Enterprises are learning that AI performance depends as much on power management and memory flow as on model size. The emerging playbook blends openness and pragmatism. AMD’s push for ROCm parity, WEKA’s storage orchestration, Clarifi.ai’s cost-per-token breakthroughs, and Supermicro’s turnkey “AI factory” clusters all show the ecosystem maturing through real-world iteration.

At the enterprise layer, leaders such as Martin Harryson from McKinsey and Nitin Gupta from Mondelez underscored that adoption fails when AI is treated as a side project. True gains come from redesigning processes, not simply adding tools. Governance, telemetry, and capacity planning are becoming standard operating layers, not afterthoughts.

Women in AI Breakfast: Rebecca Naughton (Lambda), Carmen Li (Compute Exchange), Elisa Chen (Meta) and Lauren Vaccarello (WEKA)

Closing and Call to Action

The conversations in San Francisco made one truth clear: the real work of AI happens below the model layer. As compute networks expand, power grids tighten, and agents learn to act on our behalf, infrastructure will define both innovation speed and national competitiveness.

Read more insights and watch session highlights on our youtube the next few months and join us at the next AI INFRA SUMMIT to continue building the backbone of intelligent infrastructure

Executive Think Tank: Papi Meno (Outshift), Ajay Singh (WEKA), Shimon Ben-David (WEKA), Deepa Mahjan (Mckinsey), Vinesh Sukumar (Qualcomm) and Deepak Shah (Employers)

📷 Say "INFRAAA"

From the first spark at 8:30 a.m. to the last laugh long after dinner, the energy never faded. The AI INFRA Summit floor was alive—conversations flowing, ideas colliding, and connections forming that will shape what’s next. None of it would’ve been possible without our incredible crew, sponsors, speakers, and community partners—you powered the day and made it unforgettable. Huge thanks to our media partners for capturing the magic (more photos coming soon!).

Closing Team Photo with Women x AI Panel crew

Sako is having fun

Carl Brown (Supermicro), Kristin Sloan, Bill Barry Jessica Kobilova, Urvi Bhandari (Ignite), Kiriil Lazarev (Lazarev) Ron Wong (AMD), Dan Otell (AMD)

Media team hard at work

Supermicro team toasting to a great day

Team Crusoe

Gracious for the support and constructive feedback!

THAT WAS FUN, LETS DO IT AGAIN.

Upcoming Events

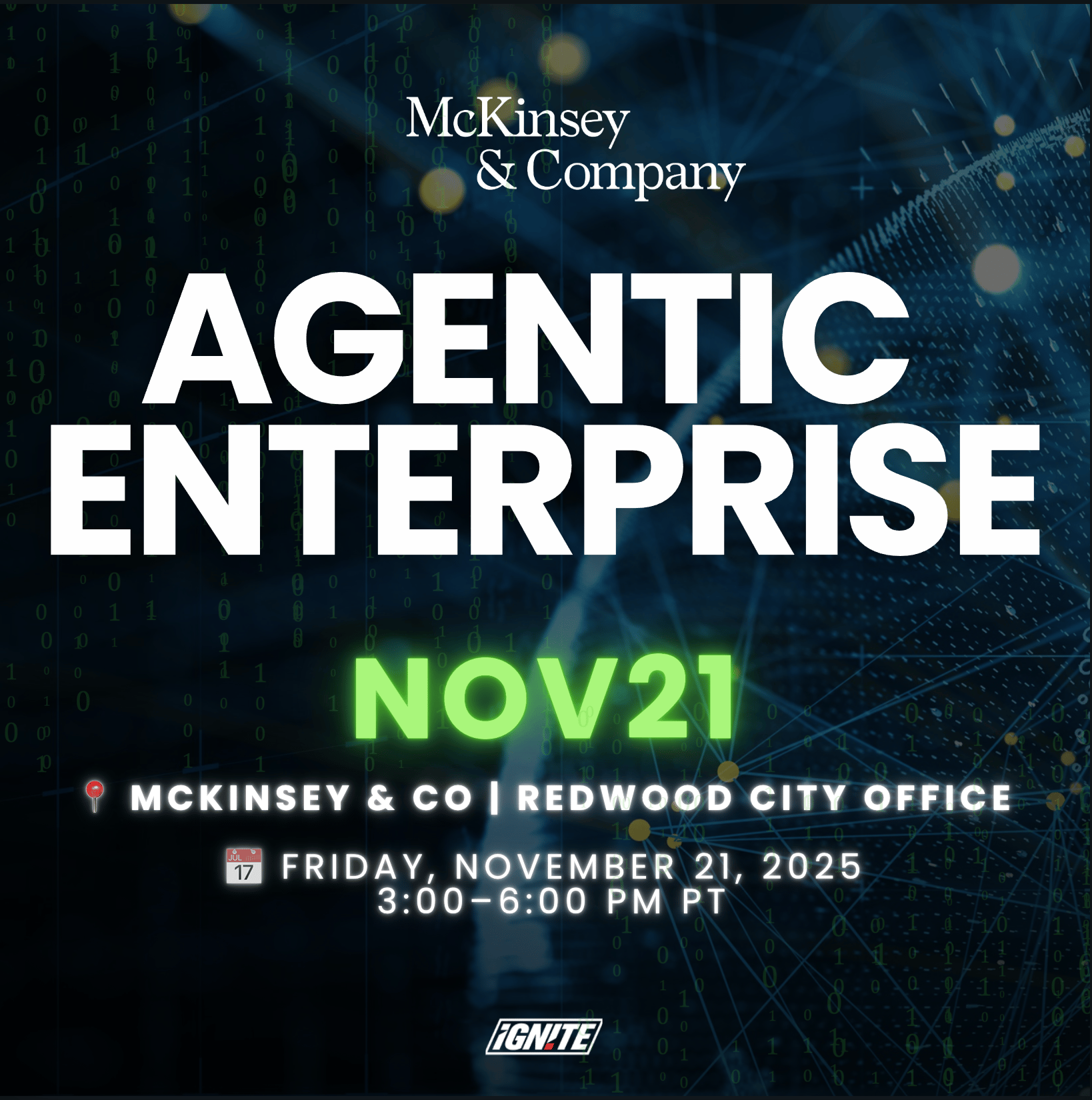

We’re closing out the year with momentum—three final events at the intersection of enterprise innovation and infrastructure evolution. Join us in St. Louis for a high-energy networking night at SC25, or meet us back in Silicon Valley as we gather industry leaders for two enterprise-driven experiences. We’ll wrap the season with a holiday-ish celebration at Hotel Valencia, Santana Row—because the future of compute deserves a toast 🥂

Bay Area Startups Collectively Secured $1.92B this week

Bay Area startups closed on $1.92B in fundings in week 1 of November, after ending October with just over $10B. Five megadeals were part of this week's total, including Ripple ($500M), Armis ($435M), just-launched Braveheart Bio ($185M) and Hippocratic AI ($126M).

PO Watch: In what are likely to be the last two tech IPOs of 2025, BillionToOne and Evommune both completed their IPOs and began trading this week. Both went well - BillionToOne in particular stood out. Their upsized offering of 4.55 million shares priced at $60, up from the initial range of $49 - $55, raised $273M and then popped more than 80% in its first day of trading, closing at $109. Evommune, after raising $150M, also did well, closing after its first day of trading with share price up 26%.

For all startups raising capital (and service providers interested in who's getting capital): The Pulse of the Valley weekday newsletter keeps you current with the startups that are getting funded and who's investing in them – and not just the big, high profile deals. We surface the 50% of early stage fundings – and their investors - that close quietly and never hit the press. Details include investor and executive connections + contact information on tens of thousands of fundings Founders get the full $50/month package for just $7/month with our Entrepreneur membership, details and signup here.

Follow us on LinkedIn to stay on top of what's happening in 2025 in startup fundings, M&A and IPOs, VC fundraising plus new executive hires & investor moves.

Early Stage:

Braveheart Bio closed a $185M Series A, a late clinical-stage biotechnology company developing novel therapeutics for hypertrophic cardiomyopathy and related conditions.

Azalea Therapeutics closed a $65M Series A, a biotechnology company redefining precision genomic medicines in vivo.

Poseidon Aerospace closed a $11M Seed, building the unmanned backbone of tomorrow's logistics.

Reo.Dev closed a $4M Seed, a modern marketing stack that decodes millions of developer activities and intent signals to help developer focused companies uncover their hidden sales funnel.

C.Scale closed a $2M Pre-Seed, a software platform enabling architects and building owners to make data-driven decisions throughout the design process, driving down both costs and whole life carbon emissions.

Growth Stage:

Armis closed a $435M Series E, the cyber exposure management & security company that protects the entire attack surface and manages the organization’s cyber risk exposure in real time.

Tachyum closed a $220M Series C, transforming the economics of AI, HPC, public and private cloud workloads with the first Universal Processor that unifies the functionality of a CPU, an HPC GPU, and AI accelerators in a single processor.

Hippocratic AI closed a $126M Series C, our mission is to develop the safest artificial Health General Intelligence (HGI).

MoEngage closed a $100M Series F, empowers marketers and product owners with insights into customer behavior and the ability to act on those insights to engage customers across the web, mobile, email, social, and messaging channels.

The EVERY Company closed a $55M Series D, a food technology company on a mission to build a more secure and accessible global food system by supplying food and beverage companies with egg protein ingredients made using precision fermentation.

Your Feedback Matters!

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering. [email protected]

Logan Lemery

Head of Content // Team Ignite

Stop Digital Shoplifters Before They Drain Your Profits

"Digital shoplifting" sneaks in after payment, costing stores shipping, revenue, and chargebacks. Chargeflow Prevent stops it before fulfillment. Free for your first 1,000 transactions.