- Valley Recap

- Posts

- 🔄 Circular AI Economy 💰 6.21B In October MTD 🧨 6 DAYS TO AI INFRA!! 🎙️ SESSIONS ANNOUNCED

🔄 Circular AI Economy 💰 6.21B In October MTD 🧨 6 DAYS TO AI INFRA!! 🎙️ SESSIONS ANNOUNCED

🧠 The AI Circular Economy:

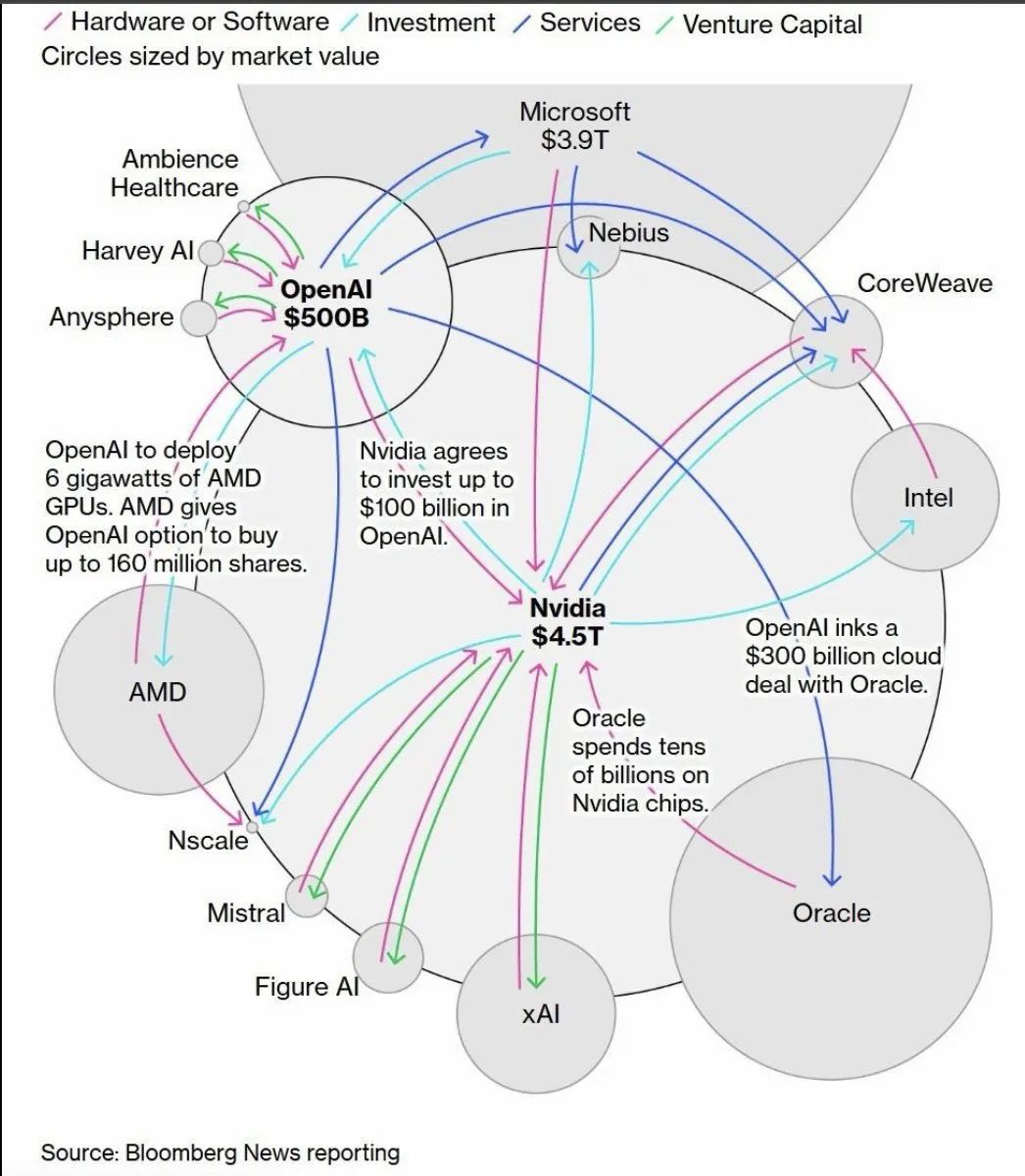

When people see billions moving between the same five companies, it is easy to think “bubble.” NVIDIA, AMD, OpenAI, Oracle, and Microsoft trade capital in loops that look self-referential and inflated.

Look closer. What is forming is a deliberate strategy to control the computational backbone of the next decade.

From Hype to Strategy

OpenAI commits hundreds of billions to Oracle for compute. Oracle buys GPUs from NVIDIA and AMD. NVIDIA invests back into OpenAI. AMD issues equity warrants tied to long-term deployments. Microsoft supports the loop through its $13 billion stake in OpenAI.

It looks circular because it is, on purpose. Each loop converts capital into data centers, cooling networks, and compute clusters that power real workloads. This is balance-sheet industrialization, a form of vertical integration similar to how Amazon used AWS to fund its own demand before the rest of the world followed.

NVIDIA’s Playbook

Earlier this year, NVIDIA signed a 10-gigawatt partnership with OpenAI, backed by more than $60 billion in operating cash from real products.

What is being built is not synthetic demand, but architectural dominance. More than 90 percent of AI developers rely on CUDA, and porting away from it can take six to eighteen months of engineering time. Each new model trained on CUDA reinforces NVIDIA’s ecosystem lock-in, making its platform the cognitive framework of modern AI.

NVIDIA’s venture arm, NVentures, invested in more than fifty AI startups last year, including CoreWeave, RunPod, and several model-as-a-service platforms. Each one becomes both a customer and a growth driver, creating a self-reinforcing loop that fuels real infrastructure build-out.

AMD’s Countermove

AMD is building its own loop. Its partnership with OpenAI covers about six gigawatts of GPU capacity, tied to stock-based incentives. AMD Ventures went from one AI deal in 2022 to more than twenty by 2025, investing in companies like Liquid AI, Ayar Labs, and Cohere.

Its long-term play is an open-standard alternative through the ROCm software stack, an effort to prevent a single-vendor monopoly and offer enterprises real choice as AI scales into production.

Real Infrastructure, Not a Ponzi Scheme

Ponzi schemes collapse because nothing real exists underneath. This loop builds data centers that draw real power, inference clusters that serve paying users, and enterprise systems embedding AI into production workflows. Even if valuations cool, the hardware remains valuable. Think of the early cloud era. Amazon built AWS to serve itself, funded startups to use it, and created a feedback loop that looked circular until it became the foundation of modern computing.

What to Watch

Utilization: Idle clusters burn money.

Vendor diversity: A single supplier creates risk.

Energy efficiency: Cooling and power discipline will determine winners.

Software ecosystems: The CUDA versus ROCm contest will shape pricing power and interoperability.

The Bottom Line

Companies are using their balance sheets to buy influence over the infrastructure of intelligence. Devansh, author of “Why Jensen Huang Loves the AI Bubble Stories,” calls it industrial consolidation disguised as hype, a race to own the rails of compute before alternatives mature.

🚀 Join the Conversation at AI INFRA SUMMIT 2025

See the builders shaping this new infrastructure economy live on stage in San Francisco on November 7, 2025, including Devansh, who will share deeper insights on how the AI circular economy is redefining global compute.

Upcoming Events

AI INFRA SUMMIT, November 7, 2025, San Francisco

The Infrastructure Moment: Inside the Breakouts Defining AI’s Next Decade

Last Call: newsletter subscribers get 50% off.

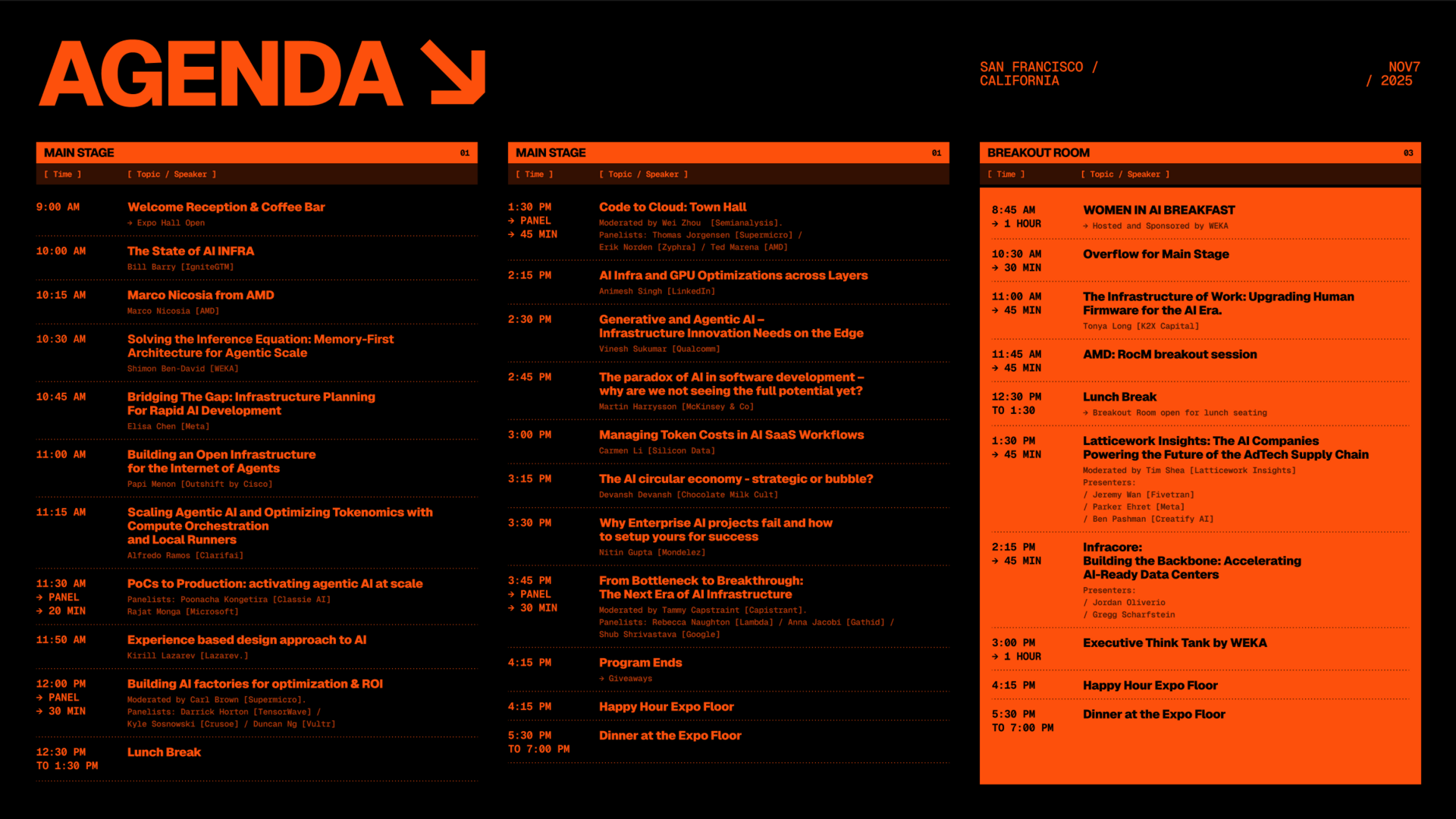

At AI INFRA SUMMIT 2025 in San Francisco, the conversation moves past theory to execution. The breakout sessions are where the industry’s most operational minds—engineers, investors, and infrastructure architects—are tackling the problems that will decide who wins the AI decade. From the data center to the edge, every topic reflects a single urgency: scale smarter, deploy faster, and align innovation with the new global AI mandate.

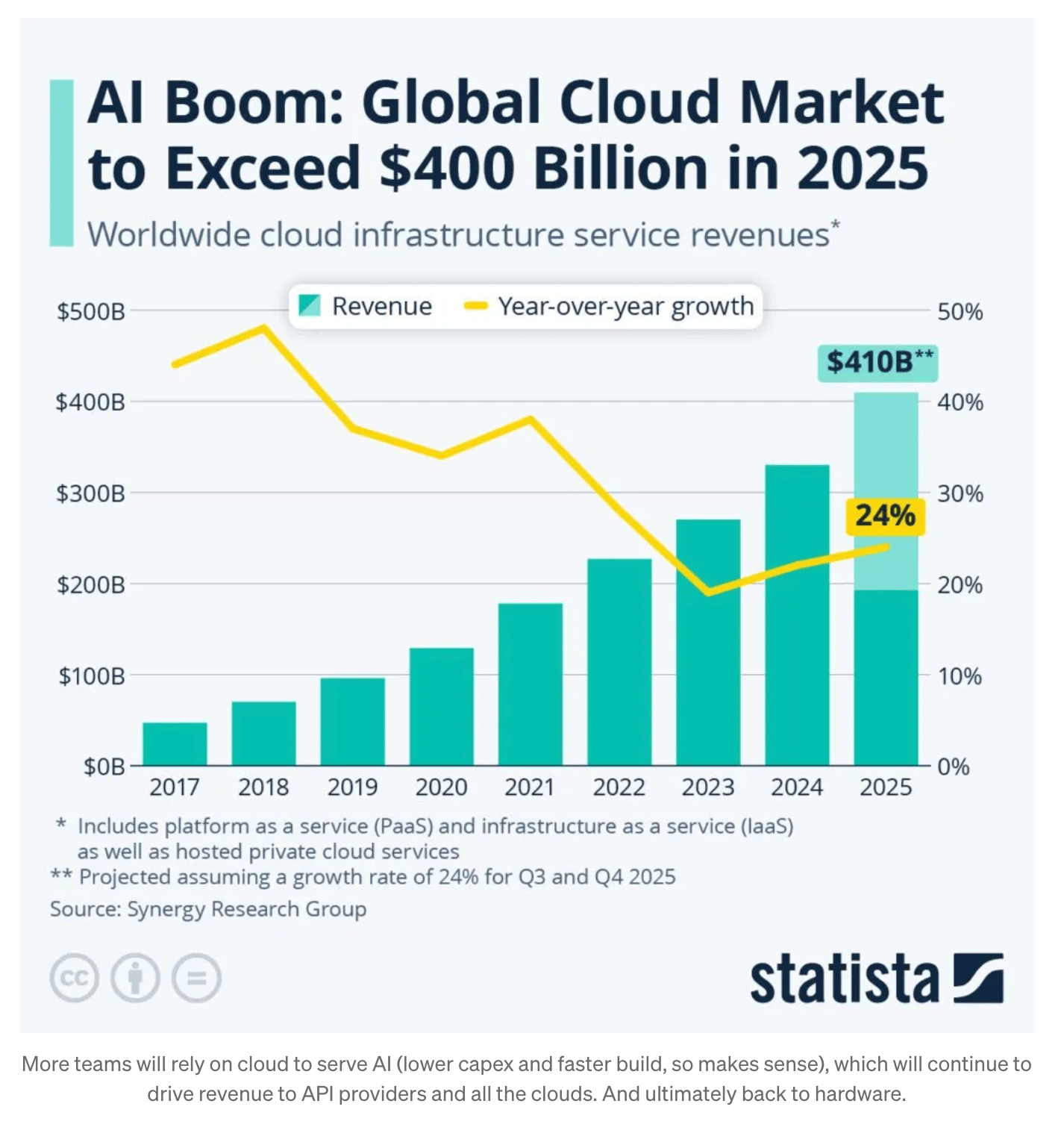

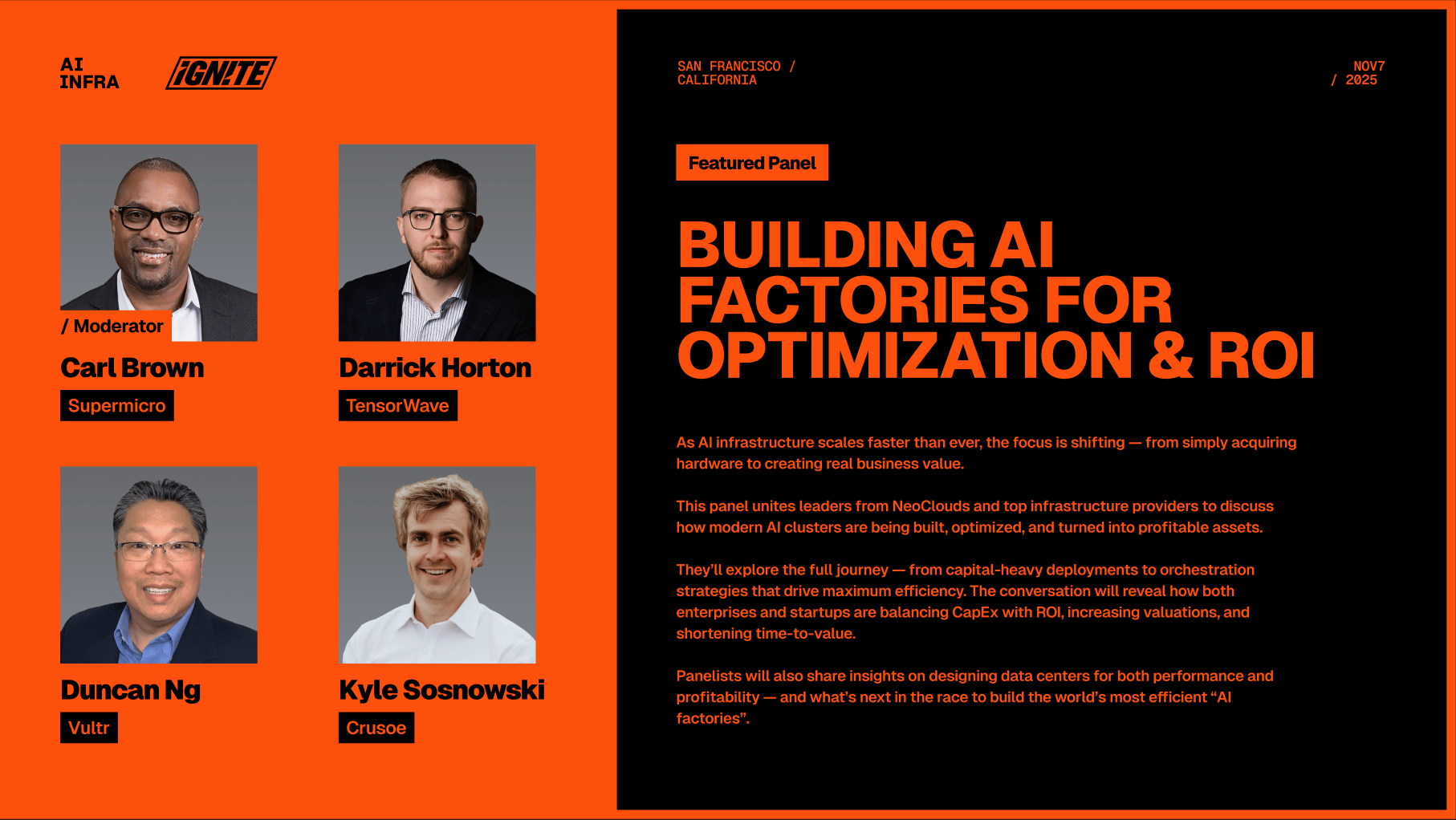

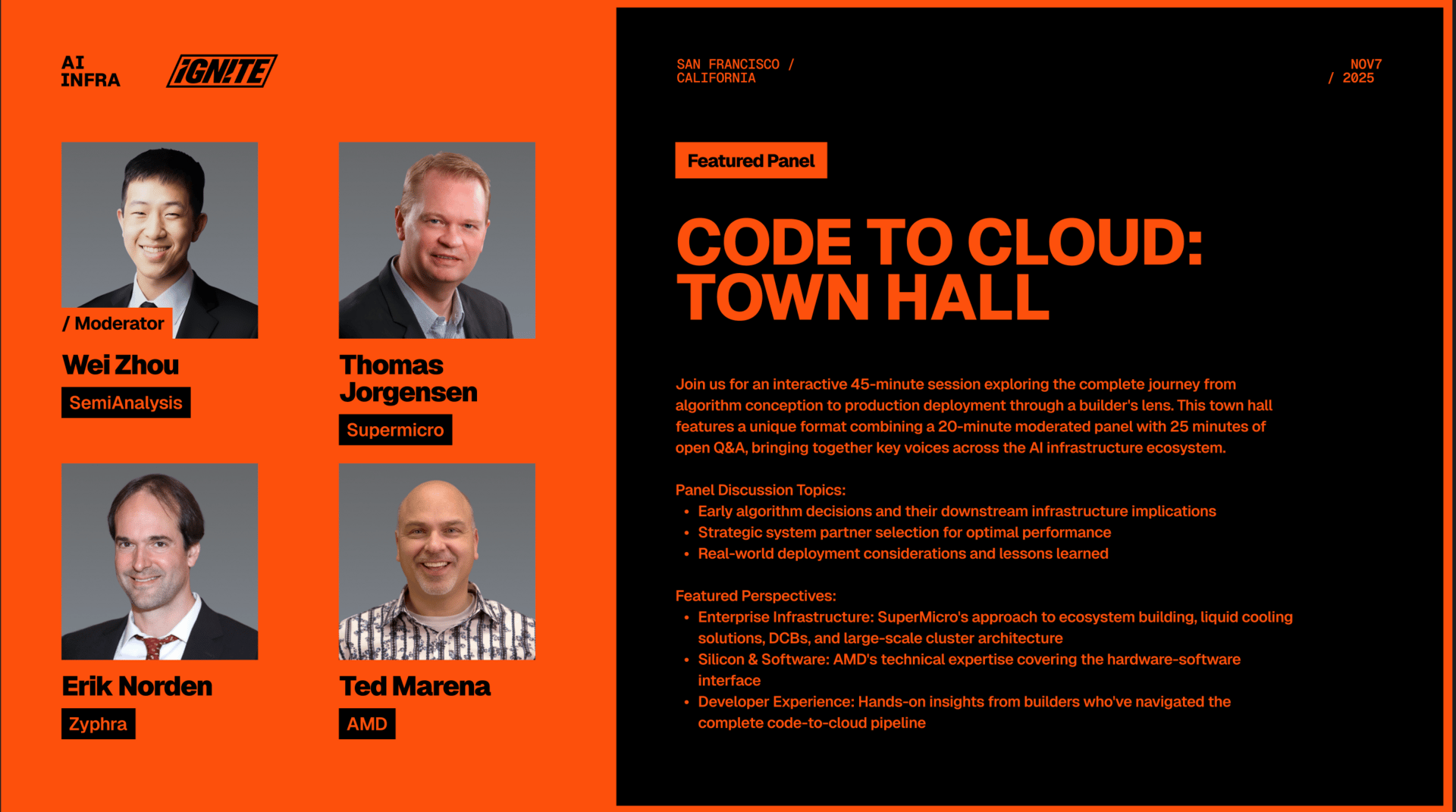

The day’s sessions track the full stack of modern AI infrastructure. Panels like “Building an Open Infrastructure for the Internet of Agents” (Cisco) and “PoCs to Production: Activating Agentic AI at Scale” (Microsoft, Classie AI) cut to the heart of deployment bottlenecks. Technical deep dives such as AMD’s ROCm breakout and “Building AI Factories for Optimization & ROI” (Supermicro, Crusoe, Vultr) focus on compute orchestration, efficiency, and the economics of scale. Thought leaders including Vinesh Sukumar of Qualcomm and Martin Harrysson of McKinsey expand the horizon, connecting edge innovation, energy constraints, and enterprise readiness.

3 NeoClouds on a Panel - Must see TV

Town Hall: Let’s talk about it.

Each discussion unfolds against a global backdrop of acceleration. As detailed in the America’s AI Action Plan and echoed throughout the Summit’s programming, infrastructure has become the new frontier of economic and national strategy. The AI INFRA breakout tracks are not side sessions—they are the command center for those building the systems, policies, and partnerships that will carry AI from lab to planet-scale deployment.

Last Call: newsletter subscribers get 50% off.

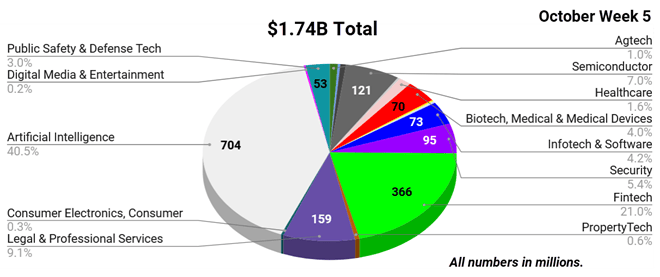

Bay Area Startups Collectively Secured $1.74B this week

Bay Area startups closed on $1.74B in fundings this week, bringing the October total to $9.75B. Five megadeals contributed to that total, with the top two going to AI infrastructure (Mercor, $350M and Fireworks AI, $250M) and the third to fintech (SavvyMoney , $225M). Harvey raised another $150M on top of the $59M first close on their Series E earlier this month and just four months after their $300M Series D in June.

This was another big week for AI, where the startup fundings were eclipsed by the magnitude of AI spending and infrastructure commitments. In their earnings reports, Meta, Alphabet, Microsoft, and Amazon announced that they plan to increase their AI spending next year to a combined $400B. OpenAI transitioned to a for-profit corporate structure - latest valuation $500B - and confirmed plans to file for an IPO at a one trillion valuation as early as 2026. At latest count, their spending commitments with multiple partners for chips, infrastructure and datacenters (30 gigawatts worth) now exceeds $1.4T. Their five-year plan is said to increase annual revenue from their current $13B to as much as $200B as one part of covering those commitments, but some analysts believe OpenAI's model is unsustainable. But to hit their revenue goals, you can expect to see them in competition with many of their customers across a wide range of markets to generate the revenue they will need.

For all startups raising capital (and service providers interested in who's getting capital): The Pulse of the Valley weekday newsletter keeps you current with the startups that are getting funded and who's investing in them – and not just the big, high profile deals. We surface the 50% of early stage fundings – and their investors - that close quietly and never hit the press. Details include investor and executive connections + contact information on 25+ years of fundings and business activity. Founders get the full $50/month package for just $7/month with our Entrepreneur membership, details and signup here.

Follow us on LinkedIn to stay on top of what's happening in 2025 in startup fundings, M&A and IPOs, VC fundraising plus new executive hires & investor moves.

Early Stage:

Substrate closed a $100M Seed,developing an alternative manufacturing process for semiconductors using a solution that will cut the manufacturing cost in half.

Frontline Wildfire Defense closed a $48M Series A, empowers homeowners to prepare for wildfire, monitor fires near their home, and protect their home during a wildfire event with Frontline's exterior sprinkler solution.

CoreStory closed a $32M Series A, delivers enterprise-grade code intelligence for modernization, onboarding, and governance.

WideField Security closed a $11.3M Series A, provides complete visibility into the identity attack surface, spanning human, machine, and AI identities.

Allie Systems closed a $5.2M Seed, builds AI agents for manufacturing, integrating intelligence into factory operations: learning from machines, sensors and systems to detect problems, recommend actions and coordinate responses in real time.

Growth Stage:

Mercor closed a $350M Series C, our vast talent network trains frontier AI models in the same way teachers train students: by sharing knowledge, experience, and context that can't be captured in code alone.

Fireworks AI closed a $250M Series C, the global AI inference cloud and infrastructure platform that enables teams to build, tune, and scale highly optimized generative AI applications.

Harvey closed a $150M Series E, a natural language interface to the law that makes lawyers more efficient, allowing them to produce higher quality work and spend more time on the high value parts of their job.

Curve Biosciences closed a $40M Series B, the company’s Whole-Body Intelligence models identify chronic disease states through its Whole-Body Blood Tests earlier and more accurately than other methods.

xMEMS Labs closed a $21M Series D, redefining sound and cooling with its breakthrough piezoMEMS platform.

EPic HYPE | Startup Growth, Branding, and Media Amplification

EPic HYPE, founded by Edward Preston (EP), is a startup growth and brand amplification platform that helps founders scale their businesses and capture attention through storytelling, strategy, and media. Based in Los Angeles, EPic HYPE merges startup advisory with high-energy events, podcasts, and digital marketing to drive visibility and growth.

What They Do

Startup Growth Advisory – Build actionable, data-driven strategies that help startups scale efficiently.

Brand Evangelism – Craft authentic brand narratives that attract customers, investors, and press.

Media and Events – Through The EPic HYPE Show and live events, EP spotlights founders and innovation leaders shaping the next generation of startups.

Community Access – Connect with EP’s LA-based network of investors, creators, and operators to open doors to real growth opportunities.

Why It Matters

EPic HYPE gives startups the momentum they need to be seen, heard, and remembered. With more than 25 years of experience in brand storytelling and startup acceleration, EP helps founders move from early traction to lasting influence.

📺 Watch The EPic HYPE Show on YouTube: @epicstartswithep

🌐 Learn More: epicstartswithep.com

Your Feedback Matters!

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering. [email protected]

Logan Lemery

Head of Content // Team Ignite

Stop Digital Shoplifters Before They Drain Your Profits

"Digital shoplifting" sneaks in after payment, costing stores shipping, revenue, and chargebacks. Chargeflow Prevent stops it before fulfillment. Free for your first 1,000 transactions.