- Valley Recap

- Posts

- 🔋Energy Decides the AI Race: 💰 4.47B In October MTD 🎙️ AI INFRA SUMMIT speakers announced 🎙️

🔋Energy Decides the AI Race: 💰 4.47B In October MTD 🎙️ AI INFRA SUMMIT speakers announced 🎙️

The Power Grid Decides the AI Race

The defining technology race of our time may not be about algorithms or chips, but electricity. When AI expert Rui Ma toured China’s AI hubs, she summarized her findings in one line:

“Everywhere we went, people treated energy availability as a given.”

For American AI developers, that idea feels almost impossible. The United States has the talent and hardware, but not the power.

Bring Your Own Power

Across the country, tech companies are no longer waiting for the grid to catch up. They are building their own power plants.

In West Texas, OpenAI and Oracle’s $500 billion Stargate campus includes its own gas turbines. Elon Musk’s xAI runs its Colossus data centers in Memphis with on-site generation. Equinix powers nineteen facilities using fuel cells and solar panels, while Meta is constructing a natural-gas plant beside its new Ohio site.

As the Wall Street Journal described it, this new energy landscape resembles a “Wild West” where the survival rule is simple: bring your own power.

KR Sridhar, CEO of Bloom Energy, said it best: “You build the data center. You just plug it in. That isn’t possible anymore.”

A Growing Imbalance

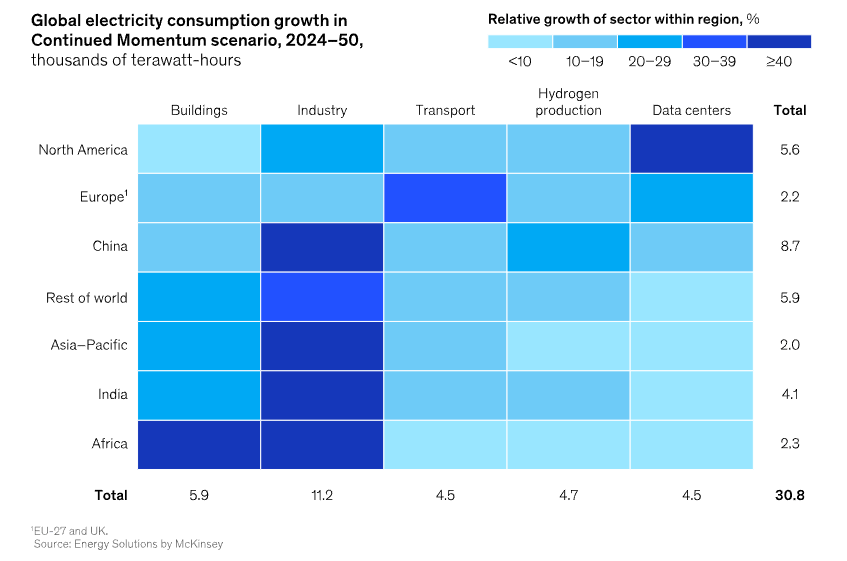

McKinsey projects that global data-center capacity will require $6.7 trillion in new investment by 2030. In the U.S., consulting firm ICF says we should be adding 80 gigawatts of generation capacity per year but are building under 65 gigawatts. That shortfall equals the energy used by two Manhattans during peak summer demand.

The numbers behind AI’s appetite are staggering. Data centers once consumed less than 2 percent of U.S. electricity. By 2028, they could use up to 12 percent, according to the Department of Energy and Lawrence Berkeley Lab. A single hyperscale facility can draw as much power as 1,000 Walmart stores, and an AI search can consume ten times the energy of a normal query. NVIDIA CEO Jensen Huang captured the strategic imbalance:

“China is well ahead of us on energy. We are way ahead on chips, but they are right there on infrastructure.”

Extraction Over Endurance

Governor Kevin Stitt of Oklahoma voiced the American workaround:

“I don’t want to play ‘Mother, May I?' ‘ Can you generate power for me? I need a gigawatt of power for AI. Grab yourself a couple of turbines.”

Oklahoma now allows companies to build private gas plants. Texas offers low-interest loans to anyone who can add a gigawatt of capacity. These efforts fill gaps Washington has left unaddressed.

China, meanwhile, added 429 gigawatts of new power generation last year and will invest twice as much as the U.S. in 2025 on energy infrastructure. America added about 50 gigawatts and built fewer than 900 miles of new high-voltage lines—half the pace of a decade ago.

Bridges, Not Solutions

Andy Power, CEO of Digital Realty, described on-site generation as a temporary fix:

“We are not in the power business. We are building bridges until the cavalry arrives.”

Analysts expect that cavalry to take three to five years. Companies such as Caterpillar are racing to supply small turbines and engines to bridge the gap. This is not innovation at work, it’s emergency engineering.

The Real Race

China treats energy as strategy, not ideology. Solar and wind exist to stabilize costs. America treats energy as a debate. The result is predictable gridlock.

Without a national reinvestment in electricity capacity, AI developers will soon compete with households for power. The future of AI will not be decided by the smartest models, but by whoever keeps the lights on long enough to train them.

AI INFRA SUMMIT, November 7, 2025, San Francisco

Meeting the National Imperative—The countdown is on.

The first batch of speakers is live, featuring the innovators behind the world’s fastest-growing neo-clouds, the masterminds of site selection, and the architects of next-gen capacity planning. Only at AI INFRA SUMMIT do you get candid debates on agentic AI, token economics, and global data center deployments—frontline topics, straight from the operators leading the trillion-dollar backbone buildout.

Lock in your pass now: newsletter subscribers get 50% off.

Why now? The AI infrastructure arms race is here—over $7 trillion in public-private capital fueling a 2x leap in global data center capacity by 2030. GenAI is set to drive 40% of total load, reshaping where and how tech gets built, and demanding value-driven action from every ecosystem player.

More visionary sessions and speakers drop soon. Don’t miss your chance to seize the advantage—be where the future gets built.

Bay Area Startups Collectively Secured $4.47B In October MTD

Bay Area startups closed on $2.34B in fundings this week, bringing the October total to $4.47B. Four megadeals came in this week, all of them late stage fundings: Oura $900M Series E, Deel $300M Series E, Kardigan $254M Series B and Upgrade $165M Series G. These four are good examples of one of the key reasons VC-funded companies are staying private longer - there is appetite and ample funding available from venture capital, private equity and other funds. Plus, the companies get to avoid the foibles of the public market, quarterly earnings reports and the increased regulatory oversight that goes with it.

IPO Watch: With holiday season starting in just over a month, and the government shutdown continuing, companies that have filed and have been waiting for the right time will have to make a decision soon. Do they push ahead with their IPO in spite of the shutdown or hold off until 2026? BilliontoOne, Ethos, Evommune, Maplight Therapeutics, Motive, Navan and Strava have just a short time to decide.

VC Acquisition: In a rare transaction that spotlights the importance of the growing secondaries market, Goldman Sachs will acquire Industry Ventures for $665M. Industry Ventures is known for pioneering secondaries - which, while still a fraction of primary, has more than doubled in the last few years as the lack of liquidity options squeezes LPs and VCs. Per Goldman, the firm has one of the largest portfolios of VC partnerships in the U.S. with investments in over 800 VC and technology focused funds, and works with over 325 venture capital firms as a value-added LP, liquidity solutions provider and co-investment partner.

Founders who are fundraising for the first time (or thinking about it): this webinar is for you - Fundraising Strategy for Seed & Pre-seed Companies on Wed. October 22 @ 4PM PT. We'll focus on the strategy you need to build a supporting network as part of identifying and connecting with angels. Bob Karr and Dawn DeBruyn Novarina will layout the strategy and show you how the LinkSV database and thousands of companies, fundings and angels can help you find those who have funded others in your space and may be interested in helping you.

Registration link: https://lnkd.in/gZJdZvf9

For all startups raising capital (and service providers interested in who's getting capital): The Pulse of the Valley weekday newsletter keeps you current with the startups that are getting funded and who's investing in them – and not just the big, high profile deals. We surface the 50% of early stage fundings – and their investors - that close quietly and never hit the press. Details include investor and executive connections + contact information on 25+ years of fundings and business activity. Founders get the full $50/month package for just $7/month with our Entrepreneur membership, details and signup here.

Follow us on LinkedIn to stay on top of what's happening in 2025 in startup fundings, M&A and IPOs, VC fundraising plus new executive hires & investor moves.

Early Stage:

Excellergy closed a $70M Series A, a biotechnology company developing a first-in-class portfolio of trifunctional effector cell response inhibitors (ECRIs) to combat severe allergic diseases and help improve patient quality of life.

CipherOwl closed a $15M Seed, the Intelligence layer for Institutional Crypto.

SirenOpt closed a $8.9M Seed, accelerating sustainable and smart manufacturing of advanced materials using intelligent characterization and real-time decision-making to drive the creation of innovative, high-performance products that fuel the advancement of society.

Trove AI closed a $7.1M Seed, offers AI agents for private equity firms.

Woz closed a $6M Seed, the first platform that applies AI with expert human oversight to build business-ready apps.

Growth Stage:

Oura closed a $900M Series E, delivers personalized health data, insights, and daily guidance with Oura Ring, the leading smart ring that helps you live healthier, longer.

Deel closed a $300M Series E, the all-in-one Global People Platform that simplifies and streamlines every aspect of managing an international workforce—from culture and onboarding, to local payroll and compliance.

Kardigan closed a $254M Series B, a patient-driven heart health company that is modernizing cardiovascular drug development to deliver medicines that move patients beyond symptom management to functional cures.

Upgrade closed a $165M Series G, helps customers move in the right direction with affordable and responsible financial products.

Reducto closed a $75M Series B, the most accurate solution for turning complex documents into AI-ready inputs.-

DEMi | Democratizing Intelligence for All

DEMi exists to make artificial intelligence open, accessible, and community driven. The organization believes that the most critical resources for AI — compute, funding, talent, and research — should not remain concentrated among a few powerful players.

Compute: Fewer than 1 percent of the GPUs needed for future AI workloads exist today, and most are owned by large corporations.

Funding: Government and private capital largely flow toward the biggest technology firms.

Talent: Top researchers are drawn into exclusive labs with multimillion-dollar offers.

Research: Breakthroughs that once came from open publication are now increasingly kept behind closed doors, creating inefficiencies and inequities across the ecosystem.

DEMi believes progress depends on keeping innovation open and distributed across builders, researchers, and communities.

What DEMi Is Building

Open AI Stack: Supporting the full spectrum of open innovation, from compute frameworks to policy.

Community Infrastructure: Connecting researchers, co-founders, and funders who share the goal of open development.

Global Collaboration: Hosting hackathons, summits, and open-source initiatives across tech hubs in San Francisco, New York, and beyond.

Continuous Evolution: Expanding in the directions that serve builders best, driven by community feedback and shared goals.

🌐 Join the network: demi.ai

Whether you are building new compute systems, developing open-source AI tools, or designing frameworks for equitable access, DEMi offers a network of innovators dedicated to reshaping how intelligence is created and shared.

Your Feedback Matters!

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering. [email protected]

Logan Lemery

Head of Content // Team Ignite

How Canva, Perplexity and Notion turn feedback chaos into actionable customer intelligence

Support tickets, reviews, and survey responses pile up faster than you can read.

Enterpret unifies all feedback, auto-tags themes, and ties insights to revenue, CSAT, and NPS, helping product teams find high-impact opportunities.

→ Canva: created VoC dashboards that aligned all teams on top issues.

→ Perplexity: set up an AI agent that caught revenue‑impacting issues, cutting diagnosis time by hours.

→ Notion: generated monthly user insights reports 70% faster.

Stop manually tagging feedback in spreadsheets. Keep all customer interactions in one hub and turn them into clear priorities that drive roadmap, retention, and revenue.