- Valley Recap

- Posts

- White House: AI Arms Race 🚀BA Startups Raise 💰 $3.7B This Week

White House: AI Arms Race 🚀BA Startups Raise 💰 $3.7B This Week

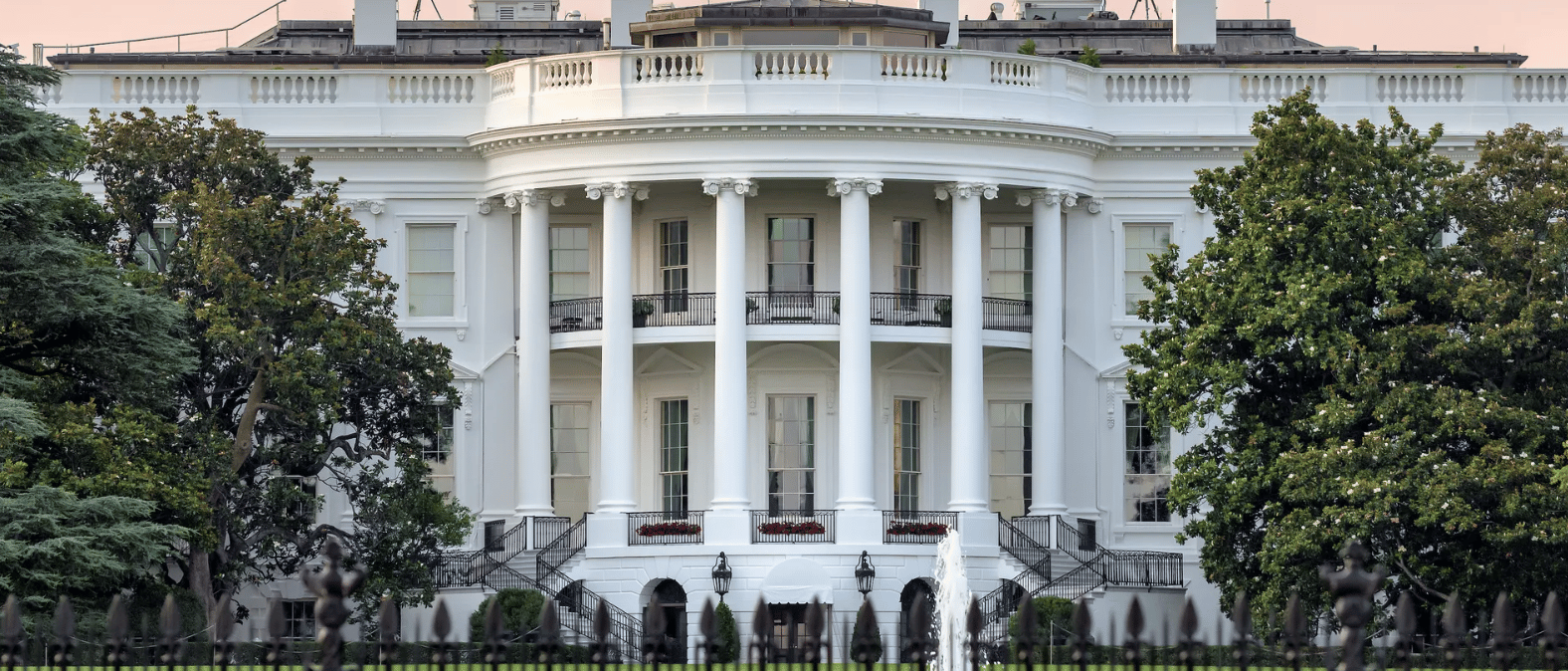

America’s AI Action Plan: An Arms Race

The release of America’s AI Action Plan has sent waves across technology, business, and policy spheres—animating a chorus of expert voices that see the initiative as both a defining moment and a high-stakes turning point. While the government frames artificial intelligence as the next arena of global competition, key opinion leaders and market figures are sounding off, outlining why this moment marks not just a next step but a wholesale new stage in the evolution of the industry.

Setting the Stage: Government Leadership and National Momentum

At the center is a clear message from federal leadership. Michael Kratsios, former director of the White House Office of Science and Technology Policy:

“America’s AI Action Plan charts a decisive course to cement U.S. dominance in artificial intelligence. President Trump has prioritized AI as a cornerstone of American innovation, powering a new age of American leadership... We are moving with urgency to make this vision a reality.”

David Sacks, recently appointed “AI and Crypto Czar,” echoes this framework, asserting that AI’s impact is existential for both the economy and global power balance:

“Artificial intelligence is a revolutionary technology with the potential to transform the global economy and alter the balance of power in the world. To remain the leading economic and military power, the United States must win the AI race… This Action Plan provides a roadmap for doing that.”

For these leaders, America now faces an imperative: to win the global contest for leadership in AI, uniting innovation, robust infrastructure, and alliances within a distinctly American vision.

Industry Response: Embracing Opportunity, Highlighting Tension

Tech industry insiders broadly welcome the plan’s emphasis on infrastructure and innovation—but their praise is measured with a sober eye toward the trade-offs. Anthropic, a leading AI developer, voices industry optimism with caution:

“We are encouraged by the plan’s focus on accelerating AI infrastructure and federal adoption, as well as strengthening safety testing and security coordination… While the plan positions America for AI advancement, we believe strict export controls and AI development transparency standards remain crucial next steps for securing American AI leadership.”

The business world is animated, but recognizes the unprecedented complexity. As one insider put it, the plan is “simultaneously a shot across the bow and an invitation”—forcing every company, investor, and researcher to reconsider their strategies and alliances under a new set of rules.

Expert and Think Tank Analysis: Framing the Race

Research institutions are quick to place the Action Plan in a global context. Graham Brookie, of the Atlantic Council, credits policymakers with recognizing the AI ecosystem’s full complexity:

“Officials have run a thorough and deliberative policy process... The resulting product provides a clear articulation of AI in terms of the tech stack that underpins it and an increasingly vast ecosystem of industry segments, stakeholders, applications, and implications.”

But not all opinions are exuberant. Cautionary notes sound throughout expert commentary:

J.D. Vance, at the Paris AI Action Summit, warned that overregulation “would not only unfairly benefit incumbents… it would mean paralyzing one of the most promising technologies we have seen in generations.”

Policy analyst Mark Scott points out frictions with allies: “The dichotomy—where the United States and EU agree on separate domestic-focused AI industrial policy but disagree on how those approaches are scaled internationally—will likely be a central pain point.”

Trey Herr senior director of the Cyber Statecraft Initiative cautions “Without knowing where this race is going, it will be hard to say when we’ve won—or if it’s worth what we lose to get there.”

A New Stage: The Global Tech Arms Race

What’s clear from this range of perspectives is that the AI Action Plan undeniably raises the bar, reframing the conversation from friendly rivalry to an urgent, strategic contest. But we need to see beyond American triumphalism.

While U.S. leadership ambitions are at the forefront, it’s critical to acknowledge that AI is now a global movement propelled by cross-border collaboration, competition, and acceleration at a pace unrivaled in the history of technology. Every policy decision and infrastructure investment in one nation echoes worldwide, shaping how countries everywhere race not only to innovate, but to adapt and set their own standards. The stakes are massive and universal: AI is evolving so quickly, with ramifications so broad, that no single country can truly “engineer the track.”

The market understands this: going forward, the future of AI will be determined not just by national agendas, but by how the world collectively navigates new alliances, divides, and breakthroughs in a field that’s rewriting its own rules in real time.

StepSF 2025 | CXO AI for FSI |

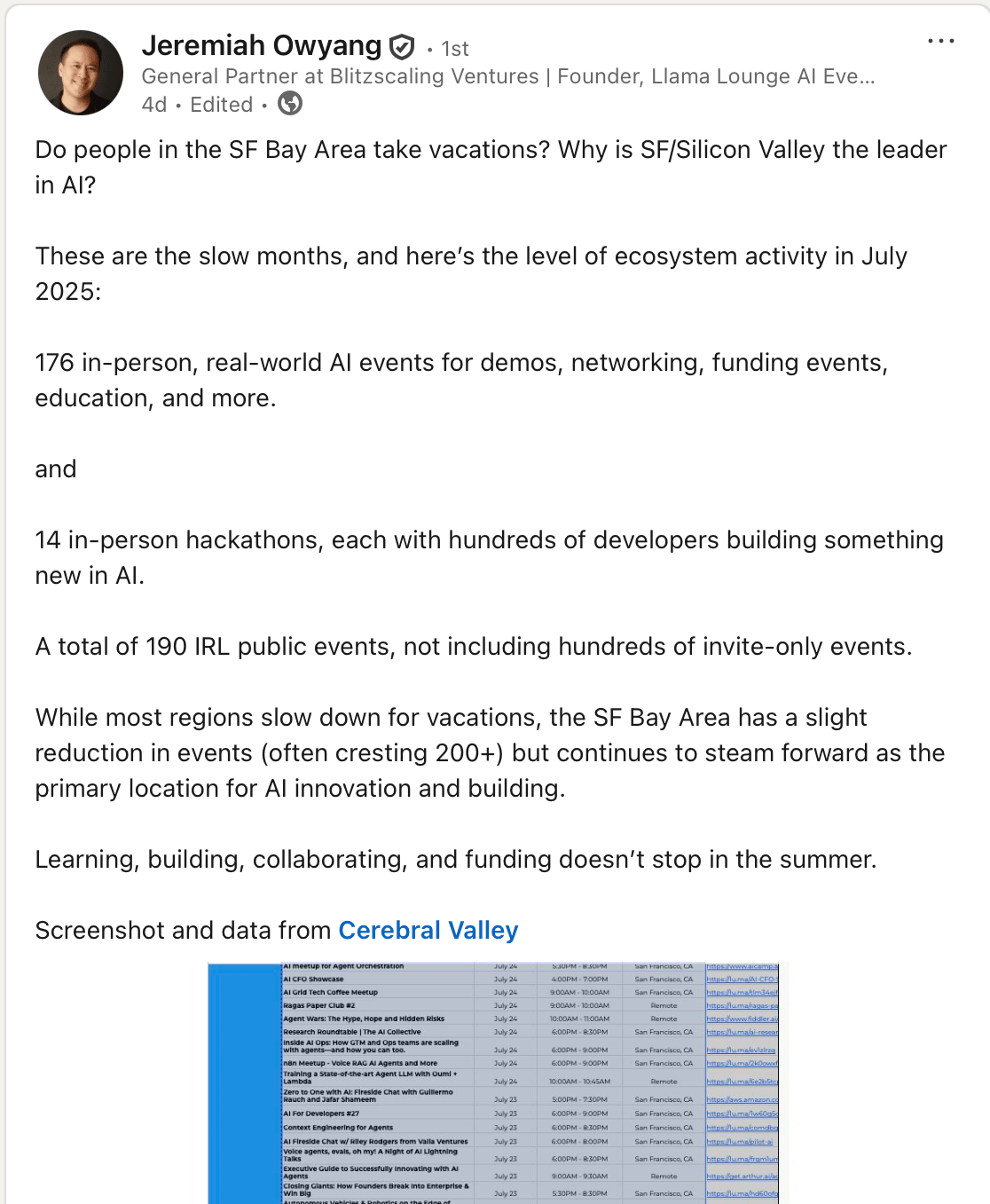

BA Startups Collectively Secured $3.78B this week

$3.78B went to Bay Area startups this week, bringing July's funding total to over $12B. There were eight megadeals, with half of them $200M+. The biggest winners this week were software (Genesys), biotech (MapLight Therapeutics), healthcare (Ambience Healthcare) and cleantech (Lyten).

IPO Watch: Figma popped in their debut, in the biggest Bay Area IPO since 2020. Hitting a valuation of more than $19B out of the gate – close to the $20B valuation in their canceled acquisition by Adobe – they ended the first day of trading at $115.50 and a valuation of $68B. That was despite the fact that 2/3 of the IPO shares sold came from existing shareholders, normally a cautionary sign. The success of Figma's IPO should launch additional moves to the public markets by the 100+ companies who have filed publicly or confidentially and have been waiting for the right time. And that's great news for the SV startup ecosystem, which has been waiting since 2022 for the return of a robust IPO market and the resulting liquidity.

Founders only: The Pulse of the Valley weekday newsletter keeps you current with the startups that are getting funded and who's investing in them – get it for just $7/month with LinkSV's Entrepreneur membership, details and signup here.

Follow us on LinkedIn to stay on top of what's happening in 2025 in startup fundings, M&A and IPOs, VC fundraising plus new executive hires & investor moves.

Early Stage:

fal closed a $125M Series C, the leading platform for generative media, offering cutting-edge inference solutions for AI-powered video, image, and audio applications.

Positron AI closed a $51.6M Series A, allows enterprises and research teams to use hardware and software explicitly designed from the ground up for generative and large language models (LLMs).

Cline closed a $32M Series A, the leading open-source AI coding agent, dedicated to transforming software development through transparent, powerful, collaborative AI.

Prophet Security closed a $30M Series A, delivering an Agentic AI SOC Platform that automates the manual, repetitive processes involved in detecting, investigating, and responding to security threats.

Estes Energy closed a $11M Seed, develops and manufactures zero-emission power systems for the electrification of commercial and industrial markets.

Growth Stage:

MapLight Therapeutics closed a $372.5M Series D, a clinical-stage biopharmaceutical company improving the lives of patients suffering from debilitating central nervous system disorders.

Ambience Healthcare closed a $243M Series C, our mission is to supercharge clinicians with breakthrough generative AI technology in a holistic suite of applications.

Motive closed a $150M Series F, empowers the people who run physical operations with tools to make their work safer, more productive, and more profitable.

Wallarm closed a $55M Series C, the only unified platform for API and agentic AI security successfully deployed in enterprise production environments.

Multibeam Systems closed a $31M Series B, accelerates chip innovation with the industry’s first Multicolumn E-Beam Lithography (MEBL) system built for volume production.

🌟 Meet The Team: Ylla Chavez 🌟

To get to know Ylla better, we asked her a few questions about her journey, passions, and what motivates her as she embarks on her professional career. Can you tell us a bit about yourself and your background? | What did you study for your BA, and what drew you to that field? What are your career goals after graduation? What made you interested in social media and digital marketing? Why did you choose to work at IgniteGTM? We’re proud to have Ylla as part of the IgniteGTM family and excited to see the impact she’ll continue to make. |

Your Feedback Matters!

Our mission is to provide an insider's view of Silicon Valley's undercurrents – insights often overlooked by mainstream sources. While many newsletters offer broad market overviews, we focus on delivering a unique, in-depth understanding of the local ecosystem. We share behind-the-scenes conversations, introduce key players we meet at events, and offer exclusive insights.

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering. [email protected]

Logan Lemery

Head of Content // Team Ignite

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.